These poverty guidelines are effective beginning Mar. KWSP Borang A TXT File.

MAKLUMAT PERTUKARAN ALAMAT CHANGES IN ADDRESS B1 Alamat surat-menyurat Correspondence address Poskod Postcode Bandar.

. W2 or W-2C. System Generated sample KWSP Borang A PDF Form. Correction to the Instructions for Forms 1040 and 1040-SR-- 08-FEB-2021.

For ease of filing you can use ezHasil to file your taxes online. Section B Use separate Form CP37 and cheque for each non-resident person to whom interestroyalty was paidcredited. System Generated sample KWSP Borang A TXT File.

KWSP Borang A CSV File. However you will be required to use the Form MMT Borang MMT instead of the Form BBE. Tax borne by the employer cost of living allowance or other fixed allowances and rate of allowances-in-kind eg.

July 2021 Amended US. Non-residents filing for income tax can do so using the same method as residents. KWSP Borang A PDF Form.

To download the KWSP Borang A CSV file click on Download CSV file button. What tax exemption or deductions are foreigners entitled to. Deadline to submit KWSP Borang A Form.

It requests the name address and taxpayer identification information of a taxpayer in the form of a Social Security Number or Employer Identification. Form W-9 officially the Request for Taxpayer Identification Number and Certification is used in the United States income tax system by a third party who must file an information return with the Internal Revenue Service IRS. 21 65 years old.

Cukai pendapatan Income tax no. How to file your income tax. Form 24.

Latest Borang B Proof of Tax Payment. Use the HHS Poverty Guidelines to complete Form I-864 Affidavit of Support Under Section 213A of the INA. Latest income tax notice of assessment or latest 6 months CPF Contribution history statement.

Latest 6 months business bank statement. Reporting Excess Deductions on Termination of an Estate or Trust on Forms 1040 1040-SR and 1040-NR for Tax Year 2018 and Tax Year 2019 --10-JUL-2020. Collection Information Statement for Businesses 0219 02192019 Form 433-B OIC Collection Information Statement for Businesses 0422 04222022.

System Generated sample KWSP Borang A CSV File. Section A If the payer does not have an Income Tax Number registration can be done at the nearest branch or by e-Daftar on the website wwwhasilgovmy. W2 or W-2C Other specify If you do not have evidence of these earnings you must explain why you are unable to submit such evidence in the remarks section of Item 10.

BORANG PEMBERITAHUAN PERTUKARAN ALAMAT SEKSYEN 89 AKTA CUKAI PENDAPATAN 1967 SEKSYEN 37 AKTA PETROLEUM CUKAI PENDAPATAN 1967. Other specify c 1. Use this revision to amend 2019 or later tax returns.

Occupational Tax and Registration Return for Wagering 1217 12212017 Form 23. Application for Enrollment to Practice Before the Internal Revenue Service. B Kadar elaun tunai seperti cukai ditanggung oleh majikan elaun sara hidup atau elaun tetap yang lain dan kadar elaun berupa barangan seperti rumah kediaman pakaian dsb Monthly rate of cash allowances eg.

PART B. If you do not have self-employment income that is incorrect go on to item 10 for any remarks and then complete Item. Reporting the Credits for Qualified Sick and Family Leave Wages in Gross Income-- 01-MAR-2021.

Valid Business Renewal License. Form 9 Form 13 if change of company name Business Registration Form. Borang BBE with LHDN Acknowledgement Receipt.

Individual Income Tax Return. Department of the TreasuryInternal Revenue Service.

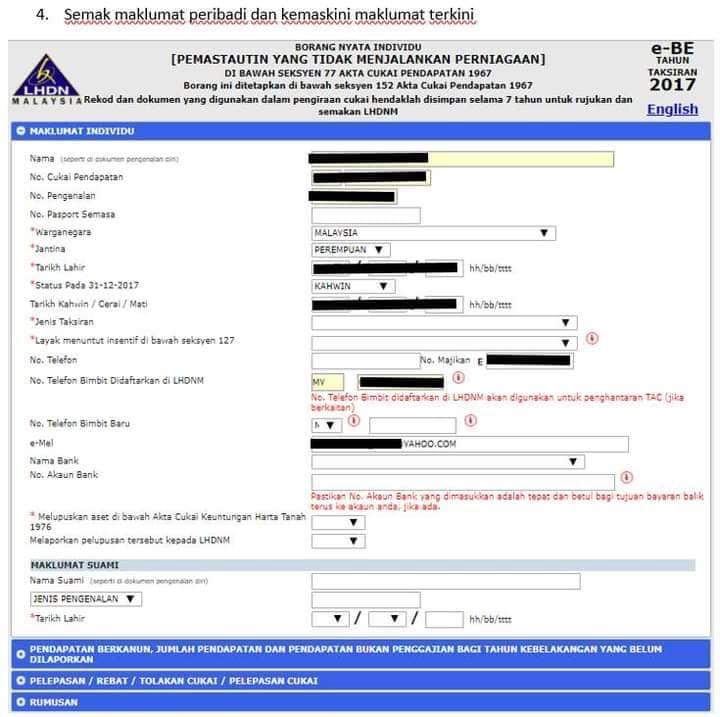

Panduan Isi Borang Be E Filing Mohon Bayaran Balik Tax Refund

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

Borang Be Cukai Pendapatan Your Tax We Care

Borang B Atau Be Bagaimana Mengisi Borang Cukai Individu Pendapatan Bahagian 1 Borang Be Pepitih

Cara Isi Borang E Filing Cukai Pendapatan Individu Borang Be B 2021

Cara Isi Borang E Filing Cukai Pendapatan Individu Borang Be B 2021

Borang B Atau Be Bagaimana Mengisi Borang Cukai Individu Pendapatan Bahagian 1 Borang Be Pepitih

Borang B Atau Be Bagaimana Mengisi Borang Cukai Individu Pendapatan Bahagian 1 Borang Be Pepitih